Award-winning PDF software

Free s Form: What You Should Know

IRS Form 1120-S. The form may also be issued for overseas corporations. About E.E.C.A. Form 15G-B with instructions from Your Tax Advisor (your tax advisor or company auditor) Use E.E.C.A. Form 15G-B, with instructions from Your Tax Advisor. About E.E.C.A. Form 2039 with instructions from Your Tax Advisor (your tax advisor or company auditor) Use E.E.C.A. Form 2039, with instructions from Your Tax Advisor. About the General Data Protection Regulation (GDPR) The General Data Protection Regulation (GDPR) requires that certain personal and behavioral data for all of you (for example financial, postal, health, and social) is treated similarly. For example, financial data, including income, savings, pension, investment, property, etc., must be processed and securely recorded. Your financial data should be treated similarly as other personal data. Form 4020-B, Income Tax Return for Self-Employed Business — Business Related Transactions Using the EEA Form 4020-B to figure your income tax withholding, claiming your self-employment tax deduction, and filing your income tax return. Form 4020-B, Business Related Transactions — IRS Revenue Cycle 2015 Using the EEA Form 4020-B to figure your income tax withholding, claiming your self-employment tax deduction, and filing your income tax return. Google Forms: Get Started | Google Workspace A quick and easy way to get started creating surveys and polls from scratch. Google Forms offers simple design templates for creating surveys and polls that can be shared on a wide range of social networks. Form 1040-ES with instructions from the U.S. Department of the Treasury (Treasury) Treasury Department Use this IRS Form 1040-ES to figure your wages and business income, as well as your income tax. Form 1040, U.S. Income Tax Return (Individual Income Tax Return) Use Form 1040, U.S. Income Tax Return, as requested by the IRS, to complete, file, and track your 2016, 2017, and 2025 federal income tax return. The form is the result of a partnership, joint, or filing with your spouse filing. You don't need to file this form if one of you has a tax return, and the other has no income.

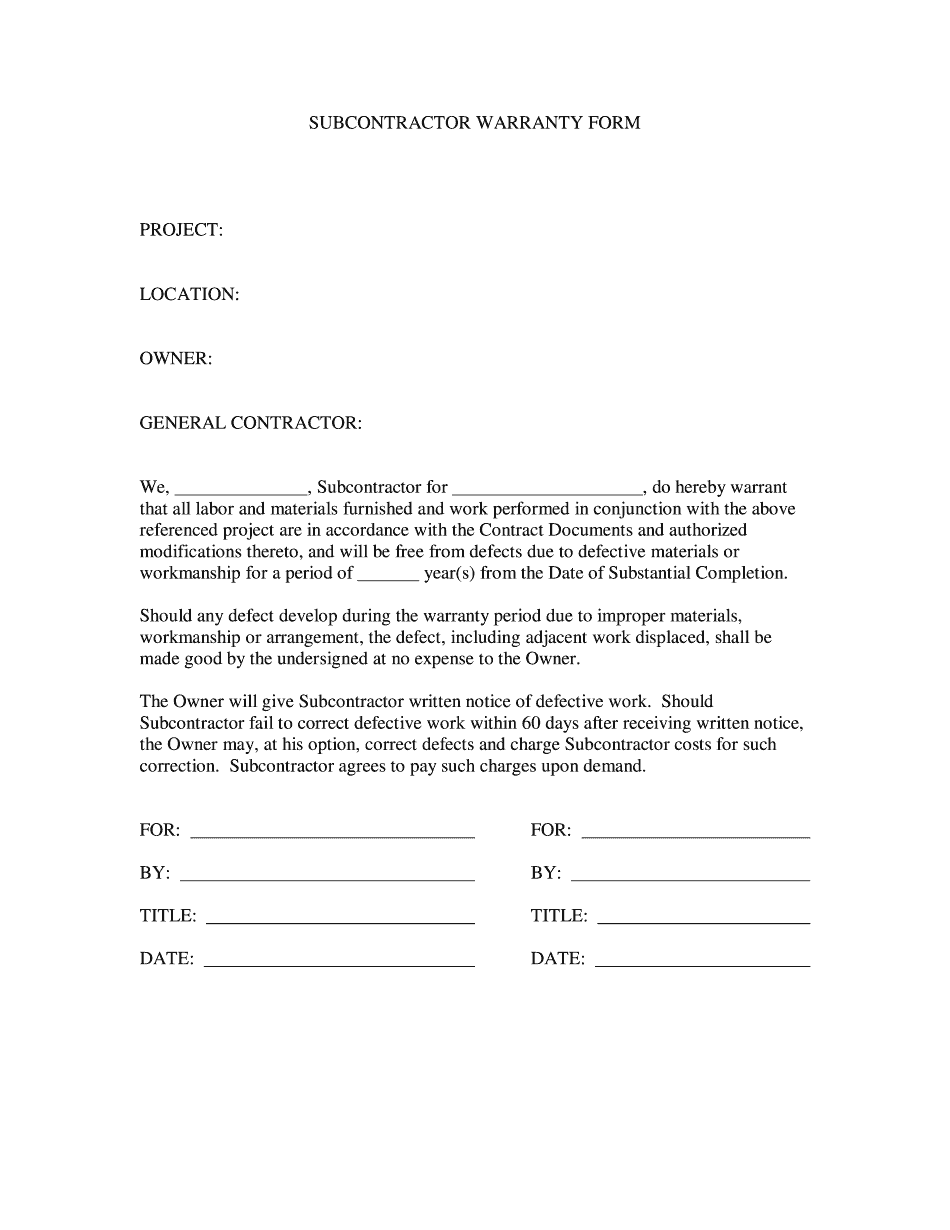

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do SubContractor Warranty Form, steer clear of blunders along with furnish it in a timely manner:

How to complete any SubContractor Warranty Form online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your SubContractor Warranty Form by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your SubContractor Warranty Form from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.